Telecom operators aren’t new to AI – they’ve quietly optimized networks for years. But with the surge in generative AI, the sector is poised to become both a major user and enabler of the next wave of global intelligence.

(Note, this is an intro-excerpt from a new RCR Wireless editorial report about AI in telecom – ‘using AI, supporting AI and getting to pervasive intelligence in telecom’ – which is free to download here. An attendant webinar on the same topic is available to watch on-demand here.)

In sum – what to know:

Familiar technology – telcos have long used AI (especially ML) to optimize operations and already possess strong data foundations.

Explosive growth – forecasts predict significant growth of AI in telecom, with generative AI driving new investment and experimentation.

Practical applications – operators are focused on practical, high-value AI use cases, balancing predictive tools with new generative tech.

The state of AI in telecom – how do you possibly get your head around such a topic? Because it is a monster, which zooms-out into rangey discussion about the multi-level progress of a world-beating technology, and zooms-in to gnarly analysis about its multi-sided impact in a world-wide domain. Except telecom is not like any other sector when it comes to AI – and anyway. Because it owns the “hub and the highway” to get AI traffic into the hands of users.

As such, it has the chance to change itself with AI, and also somehow to embed itself in the AI delivery-chain to change the global economy. Which is basically a simplified itinerary for the journey ahead; so hold on to your hats because it is a wild ride – with a whole lot of talk, as we attempt to read the map. But to start, by way of introduction, we should take stock and just ask the question: how is it going? What’s the view, right now, from the passenger side?

Stephen Douglas, head of market strategy at Spirent, climbs in and points out the window. “AI – or more specifically, machine learning – isn’t new to telcos,” he explains. “They’ve been using it in pockets for years. There’s never been a need to convince them of its value. They realized some time ago they’re sitting on massive data assets; many have built data lakes, and worked to consolidate data to optimize operations. So their foundational readiness is strong.”

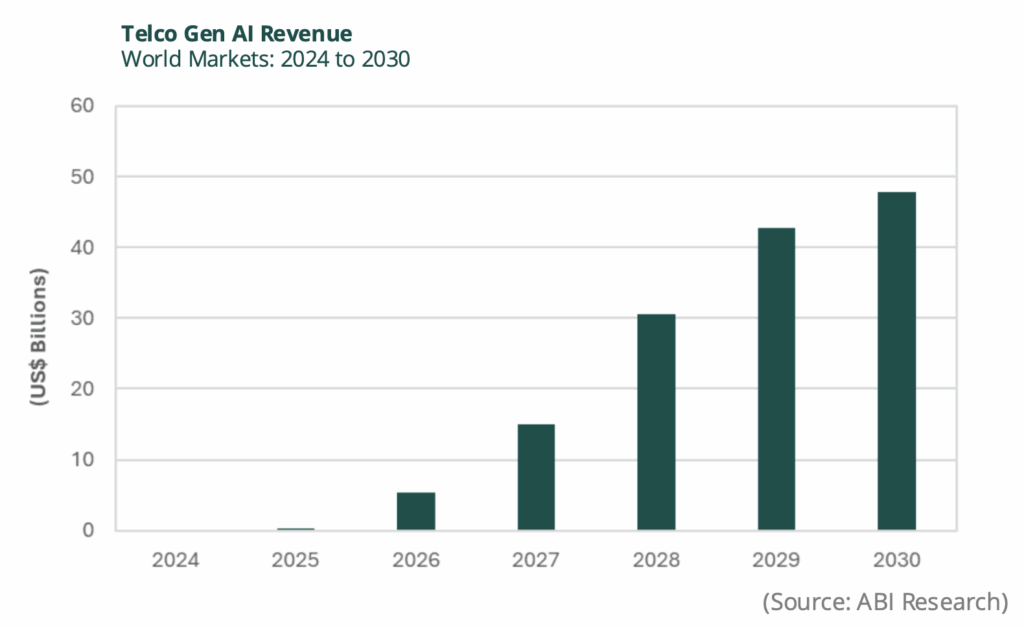

Indeed, analysts are having a field day with growth predictions: the market for telco AI will be worth $5 billion in 2029 (Omdia), $11.30 billion by 2030 (Grand View Research), $39.83 billion by 2030 (Maximize Market Research), or $58.74 billion by 2032 (Fortune Business Insights). In the end, it depends who you trust, of course, and Omdia, maybe the most trusted in these pages, forecasts a compound annual growth rate (CAGR) of 17 percent to 2029.

ABI Research, equally astute, reckons that operators will allocate $47 billion on modish generative AI solutions by 2029, from just $268 million in 2025. Douglas goes so far as to suggest “telcos are leading in AI usage and adoption”. His firm knows; it handles automated test-and-assurance for the world’s top telcos, which includes validating new AI projects before they run free (with human guidance, for now) in their systems and networks.

“This new wave just accelerates things,” he says, making reference to the swell created by generative AI. He has just recently returned (March) from MWC, the big telecom showcase, in Barcelona. “It feels like business as usual,” he says. “Telcos have narrowed down 1,000 things they could do to four or five they can do. They’re not trying to boil the ocean. They are not bogged down with more complex use cases. They’re saying: ‘Let’s get the value out first.”

Which frequently just means extending essential predictive AI (machine learning; ML) practices, and sometimes bringing in new generative AI systems on top, attached to large language models – while also investigating how and where to train smaller domain-specific language models, and how to keep them honest. These projects will be discussed through this piece, along with how telcos are looking to crash the AI infrastructure party.